地緣戰略緊張局勢正衝擊全球經濟,動搖過去三十年的商業與金融整合。面對貿易區域化及資金流向重組的可能性,金融、產業及物流領域的專家於 2 月 4 日的國家風險研討會上,分享了他們對這場重大經濟變革的見解。

在過去兩年中,俄羅斯入侵烏克蘭、哈馬斯襲擊以色列,以及中美台之間的緊張局勢,使全球環境變得特別不穩定。如今,隨著川普於 2025 年 1 月 20 日重返白宮,全球地緣政治格局再次遭受衝擊。在 科法斯國家風險論壇上,來自經濟領域的專家齊聚一堂,探討這些變化對貿易、金融與全球物流的影響。儘管全球化確實受到挑戰,但研討會上的專家認為,全球經濟並未進入全面退縮階段,而是正在經歷一場複雜的重組。

全球化的新時代

當前的地緣政治分裂趨勢,在川普政府的初步決策推動下,無疑對全球經濟與貿易格局產生了重大影響。然而,Rhodium Group 合夥人 Agatha Kratz 強調:「根據我們掌握的貿易數據,我們還不能稱這種趨勢為‘去全球化’。」這一觀點也得到了全球第三大航運集團 CMA CGM 的首席財務長 Ramon Fernandez的認同。即使 2024 年受到政治與貿易動盪的影響,全球貿易量仍超出預期。「全球 85% 的貿易經由海運進行,而我們 CMA CGM 自川普第一任期以來,運輸的貨運量不減反增,且仍在持續增長。」Ramon Fernandez指出。2024 年,全球貨物貿易增長約 6%,是全球 GDP 增長率(約 3%)的兩倍,這主要受惠於企業在 2023 年實施的庫存去化策略。

在過去五年中,歐洲對中國經濟的依賴程度增強。

Agatha Kratz, Rhodium Group 合夥人

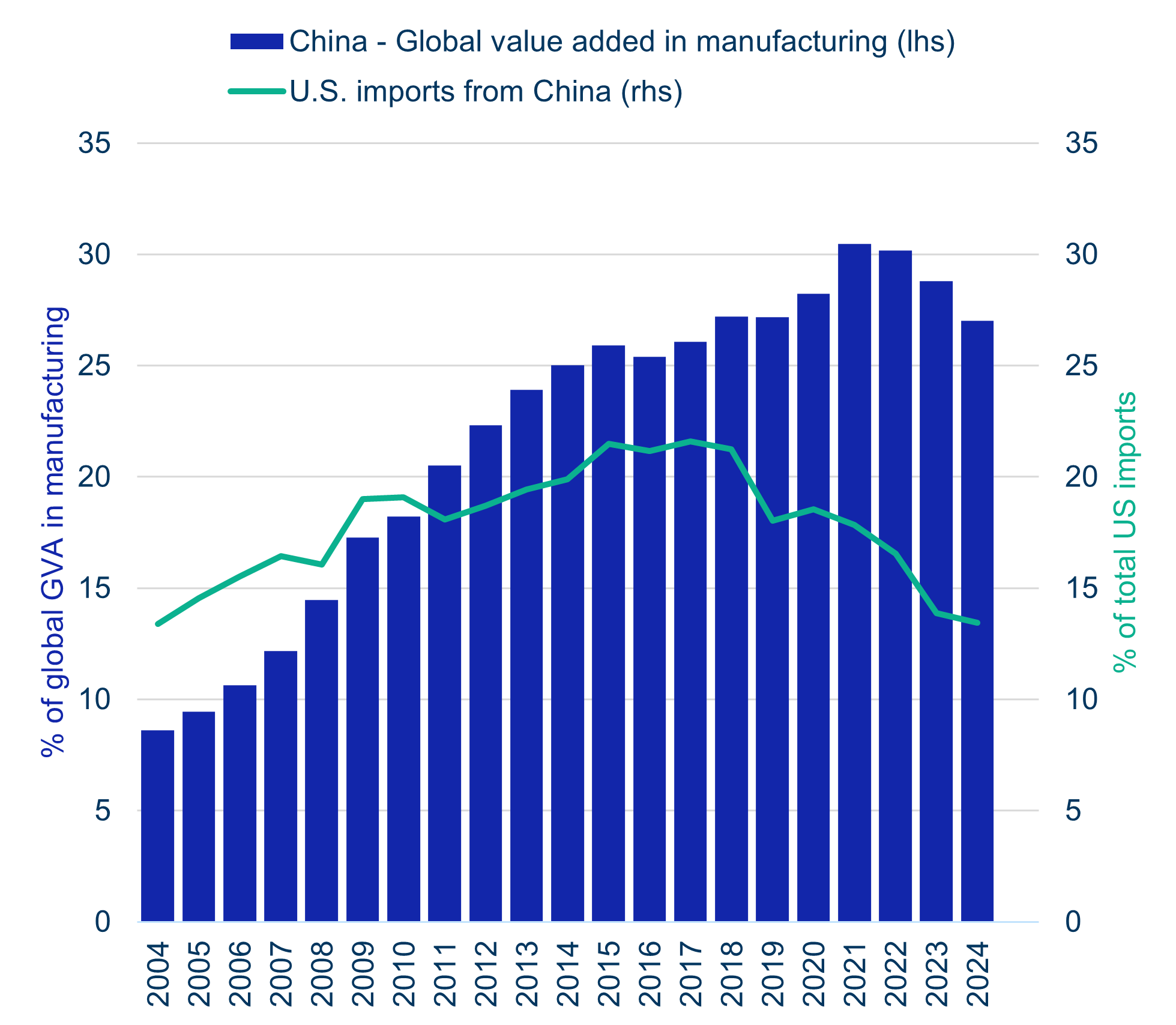

Agatha Kratz 指出:「中國在國際貿易中的影響力仍在擴大。」她進一步表示,與五年前相比,「歐洲對中國進口商品的依賴度明顯上升。」同時,她觀察到當前經濟體系中正出現「雙重裂解」。最明顯的是美中兩國在投資與貿易上的「脫鉤」(disintegration),這表現在美國自中國進口的商品比例大幅下降。下圖所示的數字顯示,中國對美國出口的下降與中國在世界生產中的份額的穩定形成了鮮明對比。

中國佔世界製造業產出和美國進口的份額(%,2004-2014)

註:生產值以毛附加價值的比例來衡量

資料來源:美國人口普查局、世界銀行、Macrobond、科法斯

Data for the graph in .xls file

此外,除了與中美緊張局勢外,中國也正逐步減少對外部市場的依賴。Agatha Kratz 指出:「中國正在減少進口,以降低對外部經濟的依存度。」然而,在金融領域,目前的地緣政治裂解尚未造成重大影響。「各大企業與金融機構仍在全球各地進行投資與融資。」Anne-Christine Champion,法國興業銀行(Société Générale)全球銀行與投資者解決方案部聯席主管表示。

新一輪貿易戰:影響幾何?

在科法斯國家風險論壇召開的幾小時前,美國政府突然宣布對墨西哥與加拿大的關稅調整暫時擱置,但仍決定對其主要貿易夥伴(首先是中國)加徵新關稅,這象徵著七年前川普發起的貿易戰再次升級。

Agatha Kratz 警告:「整體而言,全球經濟將因此受損。然而,部分國家可能從中受益,就像幾年前一樣。」她指出,墨西哥與越南等原本被視為「組裝國」的國家,近年來產業鏈開始升級並趨於複雜化。「整個東協(ASEAN)地區也因此受惠。」她補充道。

Ramon Fernandez 認同這一觀點,並指出:「亞洲仍然是一個極具潛力的貿易區。」近年來,中國對東南亞與墨西哥的出口大幅增加,而這些國家反過來也向美國出口更多產品。在已開發經濟體中,美國在綠色能源領域的表現尤為突出。「美國在電池與太陽能板等綠色產品的產業發展上表現優異,這與拜登政府的政策方向一致。」Agatha Kratz補充道。

美元仍是無可匹敵的全球貨幣。

Anne-Christine Champion, 法國興業銀行(Société Générale)全球銀行與投資者解決方案部聯席主管

在全球經濟動盪之際,美元的國際地位依舊穩固。Anne-Christine Champion 表示,雖然貿易格局發生變化,但美國金融市場的流動性與美元的避險屬性,使其仍是全球最具影響力的貨幣。

由於美國國內消費疲軟,預期中國將尋找新市場來消化因高關稅無法出口至美國的商品。在此背景下,專家認為部分中國出口品將轉向東協國家、全球南方國家(Global South)及歐盟市場。這可能會進一步激化歐盟與中國的貿易關係。Agatha Kratz 警告:「為了避免中國產品大量湧入對歐洲產業造成衝擊,歐盟可能不得不採取貿易保護措施。」

然而,並非所有企業都視此為威脅。法國家電品牌 Groupe SEB 董事長 Thierry de La Tour d'Artaise 表示:「在我們的廚具產業中,中國產品早已廣泛存在於歐洲市場,因此這種情況應被理性看待。」他認為,企業應該透過創新來保持競爭力,而非僅依賴貿易壁壘。

我們的貨運量從未如此龐大。

Ramon Fernandez, 航運集團 CMA CGM 集團財務長

監管環境的不均衡發展

歐盟在英國脫歐後,已面臨監管體系分歧的挑戰。現在,這種風險可能進一步擴大至美國。尤其在金融領域,川普政府承諾進行大規模去監管化,這對歐洲銀行業及經濟可能產生不利影響。「歐洲企業 70% 的融資來自銀行貸款,而美國企業則有 80% 來自債券市場。如果美國放鬆監管,將使歐洲企業處於競爭劣勢。」 Anne-Christine Champion指出。

此外,環境政策的差異也可能影響競爭力。「在歐洲,我們有‘碳排放交易系統(ETS)’和其他各種法規,這些措施雖然符合永續發展目標,但我們的競爭對手卻不受此類規範限制。」 Ramon Fernandez 表示。

Thierry de La Tour d'Artaise 直言:「我不太擔心人工智慧(AI),但我更擔心中國入侵(CI)和法規膨脹(NI)。我們歐洲可能會被過度監管拖垮。」

想深入了解全球貿易趨勢?立即下載完整報告!

點此觀看 2025 年第 29 屆國家/地區風險研討會圓桌論壇精彩回放 -> https://youtu.be/eJkZ5f-VhYw?si=L7X2YkAZv2f-53jj